Type of Sale

1. Bai Musawamah (Normal Sale)

In Bai Musawamah, the cost price of the goods is not disclosed to the buyer. The bank purchases the goods and sells them to the customer at an agreed-upon price, which includes a profit margin. This contract is commonly used for financing for equipment, raw materials, or vehicles i.e., A bank purchases raw material and sells them to customers at a marked-up price without revealing the original cost.

Essentials

- Subject Matter: The item being sold must exist, be halal, and owned by the seller.

- Price Agreement: The price is negotiated between the buyer and seller without disclosing the cost or profit margin.

- Mutual Consent: Both parties must agree on the sale terms.

- Delivery: The seller must be able to deliver the goods to the buyer.

Execution Process

Banks use Musawamah to finance goods without disclosing their profit margin. Here’s how it works:

- Step 1: The client identifies the goods they need financing for.

- Step 2: The bank purchases the goods and negotiates the selling price with the client.

- Step 3: The bank sells the goods to the client at the negotiated price.

- Step 4: The client pays the bank in full or in installments.

2. Bai Murabaha (Cost-Plus Sale)

Bai Murabaha involves the bank purchasing goods and selling them to the customer at a price that includes the original cost plus an agreed-upon profit margin. The cost price and profit are disclosed to the buyer. This contract is widely used for financing tangible assets like vehicles, machinery, and real estate. i.e. A bank buys a car for $20,000 and sells it to a customer for $25,000, disclosing both the cost and the profit margin.

Essentials

- Subject Matter: The item being sold must exist, be halal (permissible), and owned by the seller.

- Cost Disclosure: The seller must clearly disclose the original cost and profit margin.

- Mutual Consent: Both buyer and seller must agree on the terms of the sale.

- Immediate Possession: The seller must possess the item before selling it to the buyer.

- Mode of Payment: The payment can be on the spot or deferred over time.

Execution Process

Banks use Murabaha to finance the purchase of goods or assets. Here’s how it works:

- Step 1: The client identifies the goods they want to purchase.

- Step 2: The bank buys the goods directly from the supplier or vendor.

- Step 3: The bank sells the goods to the client at the original cost plus a pre-agreed profit margin.

- Step 4: The client pays the bank either immediately or in installments.

3. Bai Muqayada (Barter Sale)

Bai Muqayada is a barter transaction where goods are exchanged for other goods without involving currency. This contract excludes currency transactions and is less common in modern banking. i.e. A bank exchanges a piece of land for construction materials with another party.

Essentials

- Goods or Services: The items being exchanged must be lawful, clearly defined, and agreed upon.

- Mutual Agreement: Both parties must agree on the exchange terms.

- No Riba (Interest): If similar items (e.g., wheat for wheat) are exchanged, they must be of equal quantity and immediate.

- Delivery: Both parties must deliver their goods or services as agreed.

Execution Process

Banks rarely use Muqayada but can facilitate barter transactions in specific cases. Here’s how it works:

- Step 1: Two clients agree to exchange goods or services.

- Step 2: The bank acts as a mediator to ensure fair exchange and delivery.

- Step 3: The bank may charge a fee for facilitating the transaction.

4. Bai Surf (Sale of Precious Metals and Currency)

Bai Surf pertains to the sale of gold, silver, and currency. Transactions involving these items must adhere to specific Shariah guidelines to ensure fairness and prevent exploitation. i.e. A bank sells gold coins to a customer, ensuring the transaction complies with Shariah principles.

Essentials

- Currencies Involved: The currencies exchanged must be clearly identified.

- Immediate Exchange: The exchange must happen immediately (spot transaction).

- Equal Quantity: If exchanging the same currency type, the quantities must be equal to avoid riba (interest).

- Mutual Agreement: Both parties must agree on the rate and terms of exchange.

- Delivery: At least one party must take possession of the currency at the time of the contract.

Execution Process

Banks use Sarf primarily for currency exchange and trade financing. Here’s how it works:

- Step 1: A client approaches the bank to exchange one currency for another.

- Step 2: The bank conducts the exchange at an agreed rate.

- Step 3: The client receives the currency, either for immediate use or international trade.

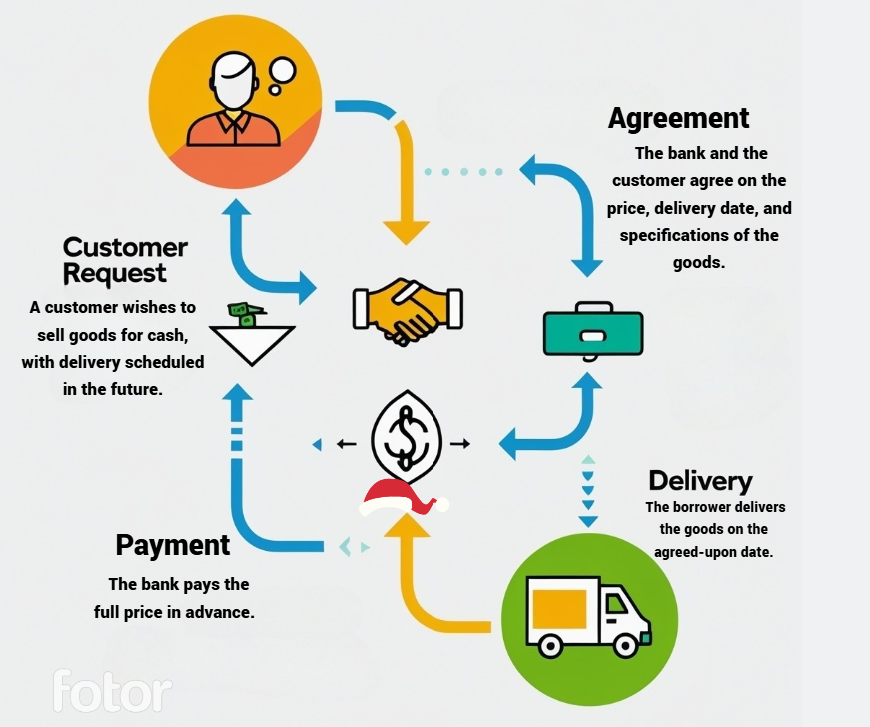

5. Bai Salam (Advance Payment Sale)

Bai Salam is a contract where the buyer pays the full price in advance for goods to be delivered at a future date. This contract is commonly used in agricultural financing, where farmers receive upfront payment for crops to be delivered later. i.e. A bank provides upfront payment to a farmer for a future harvest of wheat.

Essentials

- Full Advance Payment: The buyer must pay the entire price upfront.

- Defined Subject Matter: The quality, quantity, and delivery time of the goods must be clearly specified.

- Not Existing Goods: The goods can be produced or acquired in the future.

- No Cancellation: Once agreed, the contract cannot be revoked unilaterally.

- Delivery Time: A fixed date for delivery must be set.

Execution Process

Banks use Salam to support agriculture or commodity trading. Here’s how it works:

- Step 1: The bank pays the full purchase price to the farmer or producer in advance.

- Step 2: The farmer agrees to deliver a specific quantity and quality of crops at a future date.

- Step 3: Upon delivery, the bank can either sell the crops in the market or provide them to a client who financed the deal.

6. Bai Istisna (Manufacturing Sale)

Bai Istisna is a contract where the bank agrees to finance the manufacturing of goods to be delivered at a future date. This contract is often used for construction projects, such as building infrastructure or manufacturing equipment. i.e. A bank finances the construction of a building, with the project to be completed and delivered later.

Essentials

- Made-to-Order Goods: The goods are specifically manufactured or constructed as per the buyer’s requirements.

- Clear Specifications: Details about size, material, quality, and price must be agreed upon.

- Deferred or Staggered Payment: Payment terms can be flexible, such as in installments or on delivery.

- Mutual Agreement: Both parties must agree to all terms in advance.

Execution Process

Banks use Istisna to finance manufacturing and construction projects. Here’s how it works:

- Step 1: The client requests the bank to finance the manufacturing of goods or construction of property.

- Step 2: The bank contracts a manufacturer or builder to produce the required goods or complete the construction.

- Step 3: Once completed, the goods or property are delivered to the client.

- Step 4: The client repays the bank in installments or a lump sum.

7. Bai Taulia (Sale at Cost Price)

Bai Taulia involves selling goods at the same price as the cost price, without any profit margin. This contract is less common and is typically used in specific circumstances where the bank aims to assist customers without profit. i.e. A bank sells a product to a customer at the same price it paid for the item, without any markup.

Essentials

- Cost Disclosure: The seller must clearly disclose the actual cost of the goods.

- No Profit Margin: The seller cannot add any profit to the price.

- Mutual Consent: Both parties must agree to the sale and its terms.

- Subject Matter: The goods being sold must exist, be lawful, and owned by the seller.

- Delivery and Payment: The seller must deliver the goods, and the buyer must pay as agreed.

Financing Through Tawliya

Banks rarely use Tawliya for financing as it involves no profit. However, it can be applied in specific scenarios:

- Step 1: The client requests financing for goods.

- Step 2: The bank purchases the goods and sells them to the client at the original cost.

- Step 3: The client pays the bank in a lump sum or as agreed.

8. Bai Muajjal (Deferred Payment Sale)

Bai Muajjal is a sale where the bank sells goods to the customer with payment deferred to a future date. The sale price includes the cost plus an agreed-upon profit margin. This contract is commonly used for consumer financing, such as purchasing appliances or vehicles. i.e. A bank sells a refrigerator to a customer, with payment due in instalments over a year.

Essentials

- Price Agreement: The price must be agreed upon at the time of the sale and cannot change later.

- Deferral Period: The payment schedule and due date must be clearly specified.

- Mutual Consent: Both parties must agree on the price and payment terms.

- Delivery: The seller must deliver the goods immediately or as agreed.

Execution Process

Muajjal is widely used by banks to finance goods or assets. Here’s how it works:

- Step 1: The client identifies the goods they want to purchase.

- Step 2: The bank buys the goods from the supplier.

- Step 3: The bank sells the goods to the client at a higher price, with deferred payment terms.

- Step 4: The client repays the bank in installments or as a lump sum.

9. Bai Waddiyah (Sale at a Loss)

Bai Waddiyah involves selling goods at a price lower than the cost price, resulting in a loss. This contract is discouraged in Islamic finance, as it may lead to unfair practices. i.e. A bank sells a product at a price below its purchase cost, incurring a loss.

Essentials

- Customer Request: A customer wishes to purchase an asset.

- Asset Purchase: The bank acquires the asset from the supplier at a cost price.

- Sale Agreement: The bank sells the asset to the customer at a price lower than the cost price, incurring a loss.

- Payment Terms: The customer agrees to pay the agreed-upon price, either upfront or in instalments.

Execution Process

Banks use Wadi’ah as a mechanism for safekeeping deposits. Here’s how it works:

- Step 1: The client deposits money or valuables in the bank for safekeeping.

- Step 2: The bank guarantees the safety of the deposits.

- Step 3: The bank may use the deposits for investment with the depositor’s permission and may provide a hibah (gift) as a reward.